$AMAT- Applied Materials is looking like a good stock to buy.

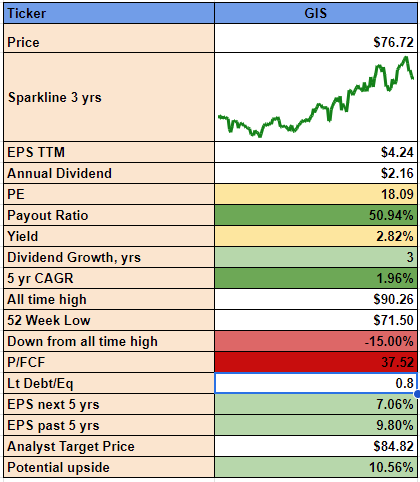

Its current PE is 25.71. This is a good value for a tech stock.

The Price to Earnings (P/E) ratio is a financial metric used to evaluate the relative value of a company’s shares. It is calculated by dividing the market value per share by the earnings per share (EPS). Here’s the formula:

This ratio can give you an idea of what the market is willing to pay for a company’s earnings. A higher P/E ratio might indicate that the market expects future growth in earnings, while a lower P/E ratio could suggest that the stock is undervalued or that the company’s growth prospects are not as strong.

Dividend payout ratio: 19.39%.

The Dividend Payout Ratio is a financial metric that measures the percentage of a company’s net income that is distributed to shareholders in the form of dividends. It’s an indicator of how much money a company is returning to shareholders, versus how much it is retaining to reinvest in the business, pay off debt, or add to cash reserves.

The formula to calculate the Dividend Payout Ratio is:

Free cash flow payout ratio: 17.70%

The Free Cash Flow Payout Ratio is a financial metric that compares the dividends a company pays out to its shareholders to the free cash flow it generates. This ratio is particularly useful for investors who are interested in the sustainability of a company’s dividend payments. It can be calculated using the following formula:

A lower ratio suggests that a company is using a smaller portion of its free cash flow to pay dividends, which may indicate a more sustainable dividend policy. Conversely, a higher ratio could mean that a company is returning most of its free cash flow to shareholders, which might not be sustainable in the long term

Free Cashflow yield: 4.26%

Free cash flow margin: 28.63%

ROIC: 31.04%

ROE: 41.04%

Debt-to-equity: 0.34

$AMAT - Applied Materials has consistently demonstrated growth in revenue over the years. The revenue has been growing since 2013. Its 5-year revenue growth CAGR is 8.98%

$AMAT - Applied Materials, Inc. has demonstrated strong free cash flow performance over the years. Its 5-yr free cashflow CAGR is 23.68%

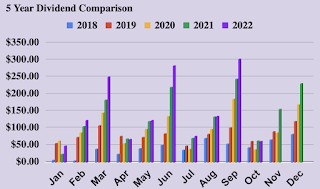

$AMAT - Applied Materials continues to reward its shareholders with steady dividend payments and growth. Its 5 year dividend CAGR is 11.75%.

$AMAT - Applied materials companies' outstanding share numbers keep dropping while the net income keeps going up which means the EPS will increase.

When a company’s outstanding shares decrease while net income increases, it has several implications:

Earnings Per Share (EPS) Impact: EPS, which represents profit per share, tends to rise. Since net income is divided among fewer shares, each share “owns” a larger portion of the profit.

Positive Signal: Investors often view this as a positive sign. It suggests that the company is efficiently managing its capital structure and returning value to shareholders through buybacks or other means