Hello all, I am sharing my projected yearly income form dividends. I have started to invest in 2017. Since then I am investing in dividend paying stocks. The advantage of dividend investing is that I will have yearly income from my investment which I am reinvesting to grow my wealth and every company increase their dividends yearly. So more yearly income, more stocks, and more dividends.

The above figure shows my current yearly income from dividends. In 2017, I had no income from dividends and now in 5 years I am earning $2,408 yearly.

The above figure shows how my income increased since 2017. There is a big drop in 2020 as I had to sell some shares to finance my first home.

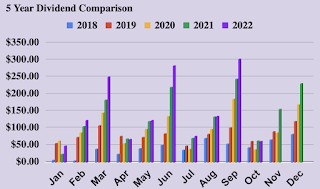

The above chart shows my dividend income monthly in the last 5 years. You can clearly see that my income is keep increasing yearly. The simplest rule is to reinvest the dividends and keep addning more stocks monthly.

The above figure shows my quarterly income since 2018. In 2018, I was earning only $100 per quarter and in 2022 I am earning more than $400 quarterly which is more than 4 times.