My portfolio update in August 2019

Today I am updating and sharing my portfolio for the month of August 2019. I am a little bit late of updating my portfolio this month. All the prices in the blog are based on September 1st, 2019. Currently, I am holding 29 stocks. This month I have added Exxon Mobil (XOM) for the first time. The price of the stock dropped to $66 and I couldn't resist myself to initiate my position into this company. My yield on cost (YOC) is 5.82% and my average cost is $67.2. Other than that I have also added Abbvie(ABBV), Emerson Electric(EMR), 3M (MMM), Kraft & Heinz(KHC), Pfizer (PFE), Albemarle (ALB), and Johnsson & Johnsson(JNJ) stocks. I have also sold half of my positions of Comcast (CMCSA), Master Card(MA), Visa(V), and Honeywell(HON). The reason I sold these stocks because I am preparing for recession and I have decided to buy only high dividend-paying stocks. MA, V, and HON are quite expensive right now that's I sold half of them and currently holding cash.

Below is the pie chart of my portfolio diversity based on sectors from Morningstar. last month I have added mostly in the health and the industry sectors. In the coming month, I am planning to add a utility stock in my portfolio. Unfortunately, most of the utility stocks are expensive. This month my holdings in the financial sector dropped from 23% to 17% due to the selling of MA and V.

The chart below shows my portfolio diversity and you can see that Apple(AAPL), Home Depot(HD), and JP Morgan(JPM) are my majority holdings.

The plot below shows my projected annual income in terms of dividends. On August 31st my projected income through dividend was $1010.42. I have set my target to earn $100 per month through dividends which is $1200 per year. In the previous month, my yearly income was $955.32. So in one month, my income increased $55.1 which is 5.76% increase in one month.

The current yield of my portfolio is 3.12% and the yield on cost (YOC) is 3.51% which has a healthy increase compared to the YOC of last month (3.3%).

The figure below shows the comparison of my current yield and YOC with time. The curve shows that my YOC is higher than my current yield. Current yield depends on the dividend rises or drops and also on the bear or bull market. If the market is in bull mode then the yield will drop and in the bear market the yield goes up. The yield on cost depends on the dividend rise and cut. So for long term scale YOC will gain and goes well above the current yield.

My projected annual income through dividends with time is shown in the following chart. My income is growing every month.

The table below shows the dividends that I received in the month of August 2019. My month was mainly dominated by the divies from ABBV and T.

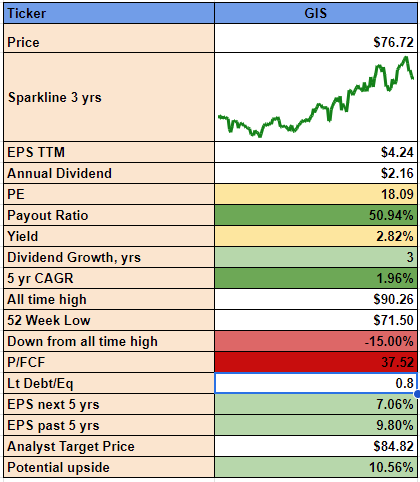

The following chart summarizes the performance of my stocks. The prices are based on August 31st 2019. So the prices will not be accurate with the current market price. From the chart you will see my biggest gained stocks are Mastercard(MA), Visa(V), Microsoft(MSFT), and Procter and Gamble (PG). My lossing stocks are Kraft & Heinz (KHC), Abbvie (ABBV), and Albemarle (ALB).