January 2020 - Monthly Dividend Update

In January 2020, I have received a total of $62.34 in dividends. The table below shows the amount of dividends that I have received from the companies. This part of the quarter I receive the least amount of dividends. My highest paying company is JP Morgan (JPM) stock then followed by Medical Properties (MPW). This month my YOY is only 13%. I have added a few stocks of PPL corp and added GAP Inc (GPS) for a short time. Because of the addition, my dividends increased from the last quarter.

The following chart shows the dividends received monthly from my portfolio. The chart clearly indicates the growth of my monthly dividends with time.

The following chart compares my monthly dividends on a yearly basis. In the last month, I have received $62.34 while in the same month in 2019 I received $54.7 which is 13% YOY growth in income through dividends.

The next chart shows the total amount of dividends received on a quarterly basis. My previous two years had seen an increase in dividends every quarter. This year I am also expecting a similar increase in dividends.

On a yield basis, the current yield of my overall portfolio is 2.99% while my yield on cost (YOC) is 3.78%. For a dividend investor like me, YOC is an actual yield than the current yield. The current yield varies with the market condition. The bull market moves the yield lower and vice versa for the bear market. However, the YOC only increases with time if you invest in dividend growth stocks. If you only invest in these types of companies your YOC will only increase with time.

My projected annual income in January 2020 is $1214.38. This month my dividend income increased by $40 in total. This is the first time my annual income crossed $1200 limit which was my first goal to earn $100 monthly from dividend income. That's a real passive income. I will keep investing every month and just imagine how much my monthly income will grow as time passes by.

The chart below shows the average dividend income received monthly and the average amount of dividends received monthly. I am slowly increasing my passive income and if I continue to invest in the dividend-paying stocks it will only grow. At the time of retirement, I don't need to rely only on my social security income.

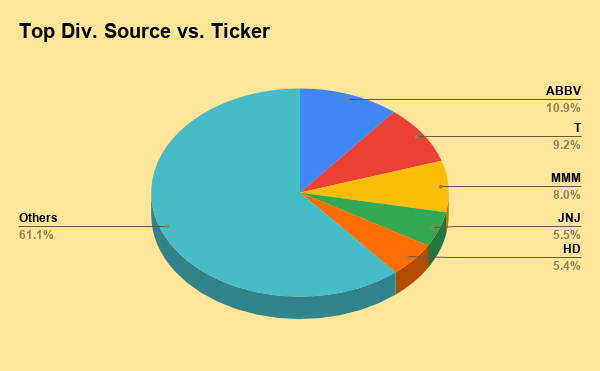

The chart and table below summarize my dividend distribution in the portfolio. The most percentages of dividends I am receiving are from ABBV and T. I also invested in BP this month so my 3rd highest paying dividend stock is BP. I am planning to add more BP this month. I am also worried about the Kraft & Heinz (KHC) stock. They lowered their dividends last year and some analysts are saying that they will again lower the dividends. If they again decrease then my income will be lower. Its dividend safety score is only 29 so there is a high chance that they will cut their dividend again. So I am planning to make my position to less than half and will buy BP with that money.

The following table shows the dividends that I received from my positions in each month. In January 20 I have received dividends from JPM, MPW, IRM, and PPL mostly.

The next table shows the total dividends received in 2020 from my positions. So far this month I have received $62.34. This chart will help me to keep a record of my yearly income.

The next table shows my dividend growth performance in 2020. Out of my 33 stocks, 10 of them already increased their dividends. Bristol-Myers Squibb (BMY) and Chevron (CVX) increased their dividends 9.8 and 8.4% respectively compared to the last years 4 and 6% increase. ABBV, Mastercard (MA), and Comcast (CMCSA) also increase their dividends 10.3%, 21.2%, and 9.5% respectively.