Monthly Dividend Update May 2020

Hello everyone, today I am sharing my updated dividend growth portfolio at the end of May 2020. I always keep track of my investment portfolio in google sheet. It helps me to understand my portfolio performance so that I can make the right decision of my trades. Using the spreadsheet, I will always be updated on my investment's past performance. I am saving 10% of my monthly salary for investing. I invest 80% of that to only dividend growth stocks, 10% to only non-dividend paying stocks such as Amazon, Google, Facebook, Tesla, etc. The rest 10% I invest in cryptos mainly in Bitcoin and Etherreum. I also buy very small percentages of XTZ and CHAINLINK. I don't sell stocks that often. I am invested in the longer term. In May, I have received $91 in dividends. I do DRIP of my positions. My top two dividend-paying stocks pay dividends at this part of the quarter. I have received $29 from ABBV and $25 from T. Other stocks that paid me good amounts of dividends are from AAPL and BMY. Recently I have added Caterpillar (CAT) and Starbux (SBUX). So in the future, I will receive dividends from these two companies.

The following chart shows the dividends received monthly from my portfolio. The chart indicates the growth of my monthly dividends with time. If I keep investing to these stocks, my income will only grow with time.

The following chart compares my monthly dividends on a yearly basis. In the last month, I have received $91while in the same month in 2019 I received $73. My YOY growth is 24%.

The next chart shows the total amount of dividends received on a quarterly basis. My previous two years had seen an increase in dividends every quarter. This year it may decrease because I have sold some stocks and holding cash because of the uncertainty going on in the world. In Q1, I have seen a 24$ YOY increase on a quarterly basis. However, in Q2 my income will drop because I have sold a good number of high dividend-paying stocks.

On a yield basis, the current yield of my overall portfolio is 3.07% while my yield on cost (YOC) is 3.92%. With time my YOC will only increase because most of the stocks that I own increase their dividends each year.

The chart below shows the YOC and current yield of my portfolio with time. You can see from the chart that my YOC is going up with time

The chart below shows the average dividend income received monthly and the average amount of dividends received monthly. I am slowly increasing my passive income and if I continue to invest in the dividends paying stocks it will only grow with time.

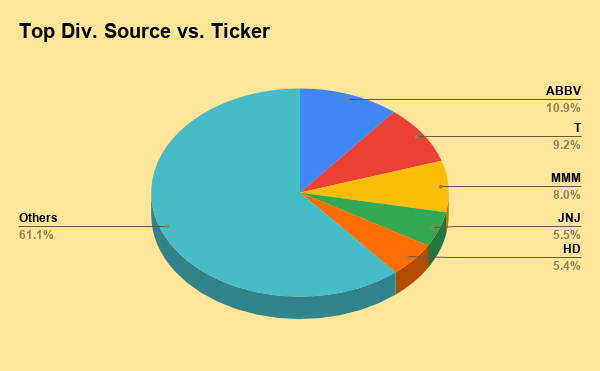

The chart and table below summarize my dividend distribution in the portfolio. The most percentages of dividends I am receiving are from Abbvie (ABBV), At&t(T), and 3M (MMM). They are covering almost 30% of my total dividend source. So I have to diversify my positions that's why I will not add any more stocks from these 3 companies. I will look to add more stocks of Home Depot (HD) and Johnson and Johnson (JNJ).

| Name | Ticker | Top Div. Source | Annual Income |

| AbbVie Inc | ABBV | 10.88% | $120.76 |

| AT&T Inc | T | 9.18% | $101.84 |

| 3M Corp | MMM | 7.97% | $88.42 |

| Johnson & Johnson | JNJ | 5.46% | $60.60 |

| The Home Depot Inc | HD | 5.41% | $60.00 |

| Others | 61.10% | $677.99 |

| | | $1,109.62 |