Portfolio Update - February 2021

Hey guys, today I am going to share with you how much money I am getting from my dividend investment portfolio. I maintain three different portfolios. The 80% of my investment goes to this portfolio. Other 10% goes to aggressive investment like TQQQ, QLD, UPRO, and ARK funds. The rest 10% goes to crypto. I have sold 50% of my crypto holdings and took some mind-blowing profit. Now comes the headache of estimated tax filing for quarter 1. Ok lets dig into my dividend stock portfolio. In this portfolio I invest into stocks which has record of paying dividends and increase the dividend rate every year. Investing in dividend paying stocks are sometimes boring but it helps to grow your wealth gradually. By investing in more dividend stock your income will increase in two different ways. Investing in dividend stocks will increase your income and the second source of increase is the dividend rate increase. The dividend stocks in my portfolio increase their dividends on average 4% per year. So if you think about longer term with a larger investment this increase every year will boost your income significantly. By following this rule, Warren Buffett is earning $3.8 billion per year in dividends according to NASDAQ website. Now lets jump into the stocks in my portfolio:

I own 41 stocks in my portfolio where AAPL is my highest position followed by Vanguard High Yield (VYM), Abbvie (ABBV), Home Depot (HD), etc. The top 10 holdings in my portfolio represents 54% of my portfolio. The following pie chart also shows my portfolio.

I diversify my portfolio by investing in different sectors. Warren Buffett famously said that "Don't put all your eggs in the same basket". If the basket falls then all of your eggs will be broken. You have to put eggs in different baskets so that if one basket fells other eggs will not be broken. Its very important to diversify your portfolio in different sectors. The following pie chart shows the sector distribution of my portfolio.

The sectors are selected based on yahoo finance. My highest position is in the tech sector (19.4%) followed by the healthcare (15.7%), consumer defensive (15.6%), ETFs (14%) etc.

The following tree map shows the stocks that I am holding the most under each sector. I really like tree maps as it gives me more in depth about my portfolio.

For example, the previous pie chart was showing that my highest holdings are in the tech sector but it was not showing which stocks I am holding the most under the tech sector. The tree map shows that my highest position is in the tech sector and AAPL is the highest position in the sector followed by MSFT and CSCO.

The table below shows the dividends that I have received in February 2021. I have received $104.62 in dividends mostly from ABBV, T, AAPL, and BMY.

On average I am currently earning $119 per month in dividends totaling $1479 per year. If I continue to invest regularly then it will keep growing and the companies will keep increasing dividends every year. This will compound the income and after few years I will start to see snowball effect. This is the magic of investing in dividends paying stocks.

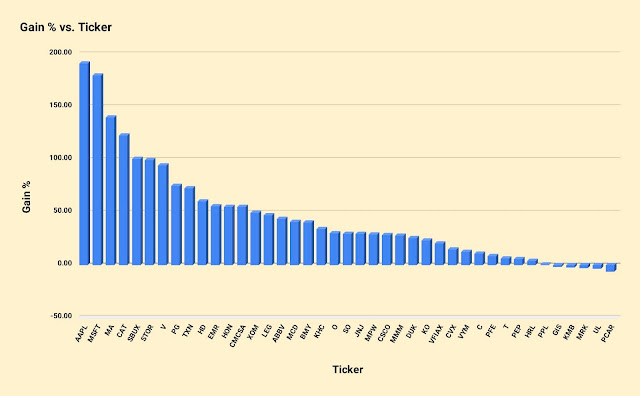

The following table shows the detailed performance of my portfolio. The current price in the table is based on the price on February 28th 2021. In the table, I have shared my current positions, annual income through dividends, total received dividends from each company's far, cost basis, YOC, current yield, and finally gain or loss with including the income from dividends. My top 5 performers are AAPL (190%), Microsoft (179%), MasterCard (140%), Caterpillar (122%), and Starbux (100%).

The chart below shows the gain vs. tickers. The stocks that I am losing are mostly new investments. The least growth stocks that I am holding for long time is At&t (T) and Ppl (PPL).

The following tree-map shows my gains in stocks under each sector. I have a huge gain in the tech although the techs are down a bit at the recent times. In the tech my highest gains are from AAPL and MSFT, in the industrial sector the highest gain is from Caterpillar, in financial sector its Mastercard, in the consumer cyclical SBUX, In the consumer defensive Procter & Gamble, In the Healthcare its ABBV, in the energy sector its Exxon Mobil, and in the real estate its Store capital.