Dividend Update May 2022

Hello Guys, today I am sharing the total amount of dividends I that I have received in May 2022. Currently, I am maintaining four different portfolios. My main portfolio is dividend paying stocks as my focus is in dividend paying stocks only. I also maintain a non-dividend paying stocks with massive growth. I invest in AMZN, GOOG, FB, NVDA, and TSLA. My third portfolio is the crypto currencies. Currently it got hammered but in the last year I have got enough profit from the cryptos. I have gradually started to buy cryptos again. My plan is to hold all the stocks for longer time. After my retirement I will sell all the non-dividend paying stocks and will invest those money to buy only dividend paying stocks to get a good monthly income during my retirement. In May, I was active in the market as I have added $SBUX, $JPM and $MPW in my dividend portfolio. In my non-dividend portfolio I have sold out $TWTR and with that money I have added $GOOG, $AMZN, and $NVDA. The table below shows the dividends I have received in May.

In the last month, I have received $122.5 in dividends. I have received $39 from $ABBV followed by $VZ ($14), $BMY ($14), $APPL ($14), and $T ($12). I used to received a big amount of dividends from $T but unfortunately they have slashed the dividends 50%. In the coming months I will add $SBUX and $JPM stocks.

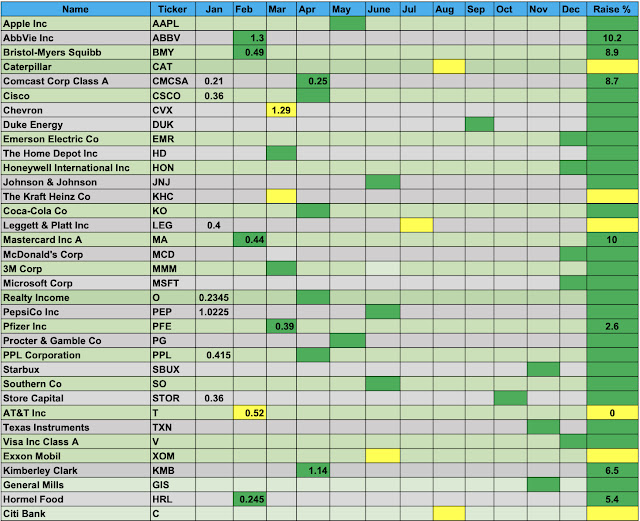

The next chart shows monthly dividend track sheet in a year. It helps me to understand how my dividends are being distributed monthly.

The chart and the table below summarizes my dividend distribution in the portfolio. The most percentages of dividends I am receiving are from the ETFs (SCHD and VYM). From individual stocks, I am receiving dividends from ABBV, JNJ, MMM, UL, PEP, HD etc.

The table below shows the detailed distribution of my total dividends.

The dividends that I have received in May, did the DRIP for all of them. The following chart shows how my dividends are growing with time.

The chart below shows the average dividend income and the average amount of dividends received monthly. You will see that my dividend income is increasing with time (red color).

The chart below shows the comparison of my monthly dividends on a yearly basis. The dividends are growing every year as I am adding new stocks and each company is increasing dividends on an avg of 6-7% a year. If I keep investing for longer run, just think about how much money this portfolio will generate. All you need is the patience.

The next chart shows the total amount of dividends received in each quarter and compares the total amount of dividends with the previous years.

On yield basis, the current yield of my overall portfolio is 2.53% while my YOC is 3.49%. The increase in YOC is because of the increase in dividends by each company. This yield only increase with time unless a company cuts the dividend. So it is very important to invest in only great companies. The current yield is dependent with he market. In bull market the yield drops while in the bear market the yield goes up.

The following curve shows the YOC and the current yield comparison with time. The YOC is gradually increasing as the companies are increasing their dividends annually.