I am a long term dividend growth investor who loves to invest in dividend growth stocks. I invest for long term and focusing to invest each month with 10% of my salary and want to reach financial freedom before I retire. I am updating my portfolio every month and sharing it with all of you.

Monday, November 21, 2022

My current portfolio distribution

Saturday, November 12, 2022

My projected dividend growth since 2017

Hello all, I am sharing my projected yearly income form dividends. I have started to invest in 2017. Since then I am investing in dividend paying stocks. The advantage of dividend investing is that I will have yearly income from my investment which I am reinvesting to grow my wealth and every company increase their dividends yearly. So more yearly income, more stocks, and more dividends.

The above figure shows my current yearly income from dividends. In 2017, I had no income from dividends and now in 5 years I am earning $2,408 yearly.

The above figure shows how my income increased since 2017. There is a big drop in 2020 as I had to sell some shares to finance my first home.

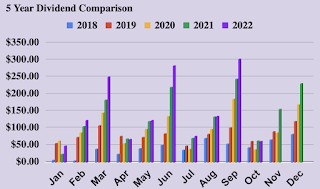

The above chart shows my dividend income monthly in the last 5 years. You can clearly see that my income is keep increasing yearly. The simplest rule is to reinvest the dividends and keep addning more stocks monthly.

The above figure shows my quarterly income since 2018. In 2018, I was earning only $100 per quarter and in 2022 I am earning more than $400 quarterly which is more than 4 times.

Sunday, June 5, 2022

Dividend Income Update May 2022

Dividend Update May 2022

Hello Guys, today I am sharing the total amount of dividends I that I have received in May 2022. Currently, I am maintaining four different portfolios. My main portfolio is dividend paying stocks as my focus is in dividend paying stocks only. I also maintain a non-dividend paying stocks with massive growth. I invest in AMZN, GOOG, FB, NVDA, and TSLA. My third portfolio is the crypto currencies. Currently it got hammered but in the last year I have got enough profit from the cryptos. I have gradually started to buy cryptos again. My plan is to hold all the stocks for longer time. After my retirement I will sell all the non-dividend paying stocks and will invest those money to buy only dividend paying stocks to get a good monthly income during my retirement. In May, I was active in the market as I have added $SBUX, $JPM and $MPW in my dividend portfolio. In my non-dividend portfolio I have sold out $TWTR and with that money I have added $GOOG, $AMZN, and $NVDA. The table below shows the dividends I have received in May.

In the last month, I have received $122.5 in dividends. I have received $39 from $ABBV followed by $VZ ($14), $BMY ($14), $APPL ($14), and $T ($12). I used to received a big amount of dividends from $T but unfortunately they have slashed the dividends 50%. In the coming months I will add $SBUX and $JPM stocks.

The next chart shows monthly dividend track sheet in a year. It helps me to understand how my dividends are being distributed monthly.

The chart and the table below summarizes my dividend distribution in the portfolio. The most percentages of dividends I am receiving are from the ETFs (SCHD and VYM). From individual stocks, I am receiving dividends from ABBV, JNJ, MMM, UL, PEP, HD etc.

The table below shows the detailed distribution of my total dividends.

The dividends that I have received in May, did the DRIP for all of them. The following chart shows how my dividends are growing with time.

The chart below shows the average dividend income and the average amount of dividends received monthly. You will see that my dividend income is increasing with time (red color).

The chart below shows the comparison of my monthly dividends on a yearly basis. The dividends are growing every year as I am adding new stocks and each company is increasing dividends on an avg of 6-7% a year. If I keep investing for longer run, just think about how much money this portfolio will generate. All you need is the patience.

The next chart shows the total amount of dividends received in each quarter and compares the total amount of dividends with the previous years.

On yield basis, the current yield of my overall portfolio is 2.53% while my YOC is 3.49%. The increase in YOC is because of the increase in dividends by each company. This yield only increase with time unless a company cuts the dividend. So it is very important to invest in only great companies. The current yield is dependent with he market. In bull market the yield drops while in the bear market the yield goes up.

The following curve shows the YOC and the current yield comparison with time. The YOC is gradually increasing as the companies are increasing their dividends annually.

Thursday, March 17, 2022

Overall performance of my total portfolio since August 2017

Saturday, September 4, 2021

Dividend Income August 2021

Dividend Update August 2021

Hello guys, today I am sharing the total amount of dividends that I have received in August 2021. Currently, I am maintaining three different portfolio. My major investment is in dividend paying stocks. I am also in some non-dividend stocks which are growth companies with the tremendous potential to grow. In my blog you can see all the details of those portfolios. In August, I have opened three new positions in Verizon (VZ), Newmont (NEM), and Intel Corp. (INTC). I have also added Clorox (CLX) and Campbell Soup (CPB) into my position. The table below shows the dividends that I have received in August 2021.

Sunday, May 2, 2021

Dividend Income in April 2021

Dividend Update April 2021

Hey guys, today I am sharing with you the amount of dividends I received in April 2021. Currently, I am maintaining three different portfolios. My main portfolio is only dividend stock portfolio. I also invest in Aggressive stocks and ETFs and a Roth IRA. In my blog you can see all the details of those portfolios. IN April, I have added Viatris (VTRS) which recently spin offed from Pfizer (PFE). They are going to initiate dividends from May 2021. They are down almost 30% from all time highs so I added them in my portfolio. The table below shows the dividends that I received in April 2021

Monday, March 29, 2021

How much money I am getting from my Dividend Stocks portfolio

Portfolio Update - February 2021

Hey guys, today I am going to share with you how much money I am getting from my dividend investment portfolio. I maintain three different portfolios. The 80% of my investment goes to this portfolio. Other 10% goes to aggressive investment like TQQQ, QLD, UPRO, and ARK funds. The rest 10% goes to crypto. I have sold 50% of my crypto holdings and took some mind-blowing profit. Now comes the headache of estimated tax filing for quarter 1. Ok lets dig into my dividend stock portfolio. In this portfolio I invest into stocks which has record of paying dividends and increase the dividend rate every year. Investing in dividend paying stocks are sometimes boring but it helps to grow your wealth gradually. By investing in more dividend stock your income will increase in two different ways. Investing in dividend stocks will increase your income and the second source of increase is the dividend rate increase. The dividend stocks in my portfolio increase their dividends on average 4% per year. So if you think about longer term with a larger investment this increase every year will boost your income significantly. By following this rule, Warren Buffett is earning $3.8 billion per year in dividends according to NASDAQ website. Now lets jump into the stocks in my portfolio:

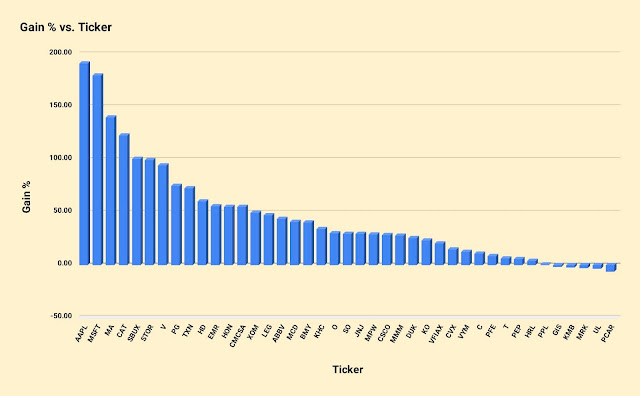

The chart below shows the gain vs. tickers. The stocks that I am losing are mostly new investments. The least growth stocks that I am holding for long time is At&t (T) and Ppl (PPL).