Why you should invest in Dividend Paying Stocks

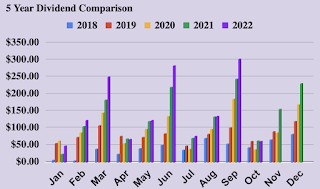

In this article, I want to show examples of how one can build wealth by investing in dividend-paying stocks over the long term by sharing the dividend income in my portfolio. I started investing in dividend-paying stocks in 2017 with no income from dividends. In 2022, I am earning $2,583 yearly from dividends. How much money am I adding monthly to my portfolio? I invest 10% of my salary in dividend stocks and reinvest all the dividends to buy back the stocks. The best part of dividend stocks is the yearly increase of dividend $ amounts and reinvesting dividends to buy additional stocks of the company’s stock which generates more income from dividends yearly. A good dividend company increases at least 5% dividends a year; some companies with high growth may increase by 20% or more. So on average, a dividend investor can see approximately ~7% increase in income from dividends which must be higher than your 9 to 5 job. To identify a good company that will keep increasing dividends, you must go through the company’s financial health and business model.

Why dividend stocks:

There are several reasons that tell why one should invest in dividend stocks:

- Potential for long-term growth: Many dividend-paying stocks have a history of paying dividends for quite a long time. These companies have already established themselves as a stable and growing company. If one keeps reinvesting the dividends, one can benefit from compounding interest and long-term growth.

- Regular source of income: The potential long-term growth dividend stocks will generate a much higher income in dividends with time which will be an attractive option for investors who are retired or looking for passive income.

- Potential to outperform non-dividend-paying stocks: When we talk about investing for the longer term, it has been found that dividend-paying stocks outperformed non-dividend-paying stocks.

Identifying the stocks:

I follow a few simple steps to identify good dividend-paying stocks that will keep increasing their dividends yearly.

- Consistent in paying and increasing dividends: The first thing I look for in a dividend-paying stock is the company is consistent in paying dividends. A company that pays dividends consistently is more likely to continue paying dividends and keep increasing dividends in the future.

- The dividend yield and payout ratio: The dividend yield and the payout ratio is very important for dividend investors. The dividend yield is the annual dividend per share divided by the stock price and the payout ratio is the percentage of a company’s earnings that are paid out as dividends. I always look for companies that pay a reasonable dividend yield and a payout ratio not higher than 80%.

- PE ratio: Price to earning ratio is also another parameter to look into. It helps to identify if the stock price is fairly valued or not. For dividend investors, this is very important as if you buy at a lower PE ratio then you are buying at a higher yield and you are buying more stocks that will generate more dividend income.

- Company’s financial health: Every investor should read the company’s financial statements that they are invested in. Look for the company’s profitability, debt levels, and cash flow. A company’s financial strength will indicate if it will be able to sustain and increase its dividends over time.

- Company’s business model: Always look at the company’s business model and how it generates revenue. Also, understand the strength of the company’s competitive advantage and its potential for future growth.

The growth: Keep patience and hold your investment for long-term

There are several benefits of holding dividend-paying stocks for the longer term.

- Potential for higher return: This is true for all types of stock investors. Over the long term, the stock market has historically generated higher returns than other asset classes such as bonds and cash. by investing for the long term, the investor can take advantage of these higher potential returns. Picking an excellent growth stock is very important in this case.

- Time to weather market fluctuations: In the short term, the market can be volatile, but over the long term, it tends to go upward. By investing for the long term investors can ride out market fluctuations and potentially get a higher return. Most of the time it also beats inflations.

- The benefit of compounding: In long-term investing in dividend-paying stocks, investors can potentially see the miracle of compounding interest. This is the process where the dividend is reinvested so that the investment earns more dividends from both the original principal and the accumulated dividends. This will help to grow wealth faster over time.