Portfolio Update - March 2020

Today I am going to share my portfolio at the end of March 2020. This month we entered the bear market and my portfolio nose dived and I had to sell all of my remaining position of Delta Airlines (DAL) and also I have lowered my positions in the British Petroleum (BP) and Exxon Mobil (XOM) to raise some cash to buy some great stocks those I was waiting for an entry point for quite a long time. In February, I have sold all of my positions in Bank of America (BAC) at $34.5, 3/4 th of my JP Morgan (JPM) at $103, and Delta (DAL) at $46. I invested in DAL for a long time but I have decided to seel all because it will take them years to recover and the dividend is not going to come soon. because I am a dividend growth investor so I don't need to be invested for long in this stock. I was so lucky that I made a quick decision to sell most of my positions at $46. I sold my last few positions at $25. I raised a lot of cash in February by selling the stocks and I was holding around 10% cash in my brokerage account. I was so much active in the market around mid March and I think I made some great investment for the longer term. With those money I have opened my position in Starbux (SBUX) at $52, Disney (DIS) at $92, Cater Pillar (CAT) at $97, Realty Income (O) at $47, Store Capital (STOR), Duke Energy (DUK) at $74, and Southern Co (SO) at $44 in March. I have also added McDonald's (MCD) at $130, Cisco (CSCO) at $37, Leggett & Platt (LEG) at $23, Johnson & Johnson (JNJ) at $123, Emerson (EMR) at $46, Honeywell at $117, 3M (MMM) at $138, PPL at $26, and At&t (T) at $27. At the end of this blog you will see my overall portfolio. Below is the table that shows my portfolio distribution:

The same table is shown as a pie chart. I have invested in Apple (AAPL) in 2018 December and since then it sky rocketed. I am adding any more AAPL as I am holding more than 10% in my portfolio. I am also not going to invest in MMM anymore. I will add more positions in JNJ, HD, and MCD if I get them cheap. Microsoft(MSFT) is looking expensive right now. I will also add more DIS, CAT, and HON. I am also keeping an eye on O, STOR, DUK, and SO stocks.

The sector distribution of my portfolio is shown in the following pie chart. The sectors are based on Yahoo Finance. Currently, my highest position is in the health sector with 20% of my portfolio. I just invested in JNJ this month but the increase is because I have lowered my positions significantly in the financial and the energy sector. My second highest sector is the technology sector with 18%. The technology performed better in March and I have added more CSCO stocks.

I always update my transaction in the tipranks website and the figure below compares my portfolio performance against the S&P 500. In most of the cases my portfolio beat the market.

My performance as a portfolio manager is also not bad. At then end of March I was ranked 1530 out of 24989 managers which is at the top 6%. My portfolio has gained 26.05% since I started to invest since 2017 August. Last month my gain was 69%. Last months bear market brought my gain down to 26%. My sharpe ratio is 0.81 while the average tiprank managers is -0.27.

My 12 month returns (TTM) is -6.07% while the YTD return is -19.5%. There may be more down turn in my portfolio but I am investing for long term so I should not be worried about this roller-coaster type movement.

The meter below shows my projected income in terms of dividends. On 31st March 2020, my projected income through dividends were $1118.99. It dropped from my last month because I have sold some high yield oil shares and holding cash. This income may drop more because some of the companies may cut their dividends.

My current yield on cost (YOC) is 3.84% while my current portfolio yield 3.54%. Because I am investing in dividend growth stocks so my YOC will continue to grow with time while the current yield depends with the market volatility. The yield will go up when the market is down and the vice versa.

The following figure shows the comparison of my current yield and YOC with time. Because the market dropped a lot, that's why the current yield is going up. This signals a buying opportunity in the market. For the longer term, if I keep investing in dividend growth stocks, my YOC will keep growing with time.

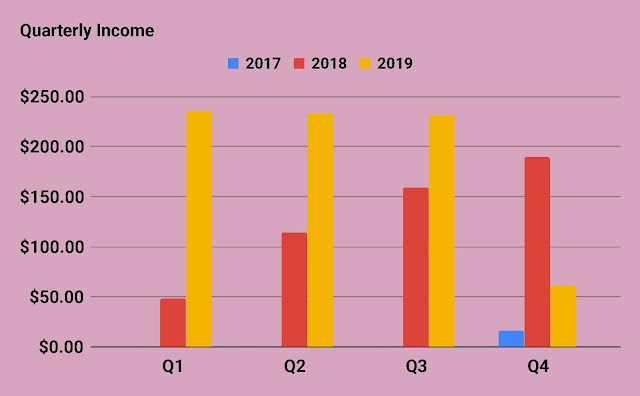

The following chart shows my growth in projected annual income with time. It is slowly but steadily increasing and this month I have received my highest earning so far through dividends.

The table below summarizes the dividends that I received in March 2020. This month I have received $144.16. My highest paying dividend paying stock for this part of the quarter was BP. Then MMM, HD, JNJ, XOM, and PFE.

The following table shows the detailed performances of my portfolio. The current prices are based on March 31st, 2020. In the chart, I have shared my current positions, annual income through dividends, total received dividends from each companies so far, cost basis, YOC, current yield, and finally the total gain or loss including the dividend income. The top 4 stocks that I gained the most so far is MSFT 91%, MA 64%, PG 55%, and AAPL 54%. Currently, I am in the downside in all the oil stocks. I am more than 30% down in XOM, BP, and CVX.