Portfolio update on October 2019

Today I am updating and sharing my portfolio for the month of October 2019. All the prices in this article are based on November 1st, 2019. Currently, I am holding 30 stocks in my portfolio. I am looking to add new stocks in my portfolio to diversify my portfolio but I cannot find any stocks which are at a big discount. In October, I added MMM stocks in my portfolio. The market is up like crazy and I don't want to invest in this market. I am holding cash and have decided to wait for the market pullback. The chart below shows my current portfolio and sector distribution.

The pie chart shows my portfolio diversity based on sectors from Morningstar. My highest position is in the consumer sector followed by the financial and healthcare sectors.

The meter below shows my projected annual income in terms of dividends. On October 31st my projected income through dividend was $1068.32. I have set my first target to $100 per month from dividends which is $1200 per year. Compared to last month my dividend increased from $1048 to $1068. The increased of $20 is due to the purchase of Exxon (XOM), 3M (MMM) stock and reinvestment of dividends.

The current yield of my portfolio is 2.92% and the yield of cost is 3.6%.

The figure below shows the comparison of my current yield and YOC with time. The curve shows that my YOC is higher than my current yield. The current yield depends on the dividend rises or drops and also on the bear or bull market. If the market is in bull mode then the yield will drop and in the bear market, it is vice versa. The yield on cost depends on the dividend rise and cut. So for longer-term YOC will gain and will be well above the current yield.

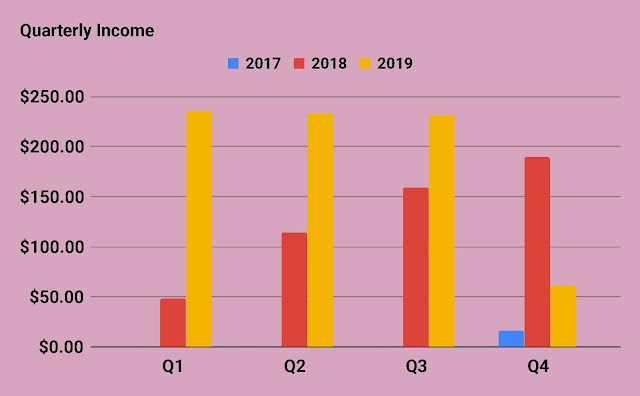

The following chart shows my growth in projected annual income with time. It is slowly but steadily increasing and reaching to achieve my first goal.

The mini table below summarizes the dividends that I received in the month of October 2019. My month was mainly dominated by dividends from JPM and Medical Prop. (MPW).

The following table shows the detailed performances of my portfolio. The current prices are based on October 31st, 2019, so the prices will vary compared to the current market. From the chart, you can see that my biggest gained stocks are Mastercard (MA), Microsoft (MSFT), Procter & Gamble (PG), and Visa (V). The only two stocks that I am losing are Albemarle (ALB) and Kraft & Heinz (KHC). However, I am expecting of a positive run of these two companies in the near future.