Dividend Portfolio Update — November 2022

Welcome to the review of my dividend growth stock portfolio that I have been maintaining since 2017. Many of you will ask what is the purpose of writing and sharing my dividend portfolio in the article. I want to show examples of how one can build wealth by investing in dividend-paying stocks over the long term by sharing the dividend income in my portfolio. I started investing in dividend-paying stocks in 2017 with no income from dividends. In 2022, I am earning $2,583 yearly from dividends. How much money am I adding monthly to my portfolio? I invest 10% of my salary in dividend stocks and reinvest all the dividends to buy back the stocks. The best part of dividend stocks is the yearly increase of dividend $ amounts and reinvesting dividends to buy additional stocks of the company’s stock which generates more income from dividends yearly. A good dividend company increases at least 5% dividends a year; some companies with high growth may increase by 20% or more. So on average, a dividend investor can see approximately ~7% increase in income from dividends which must be higher than your 9 to 5 job. To identify a good company that will keep increasing dividends, you must go through the company’s financial health and business model.

Dividend Portfolio:

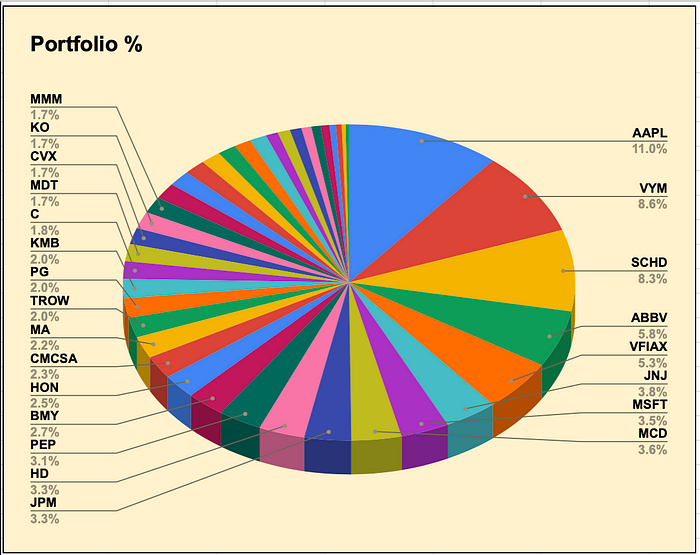

Building a dividend portfolio takes time, you just cannot start buying stocks because they have a high dividend yield. As I mentioned earlier, before buying the stocks you have to understand the company’s business model, how the company will perform in the future, the earnings growth, total cash flow, long-term debt, etc. I started to buy dividend stocks in 2017. I am doing DRIP since then and regularly investing in stocks. I have diversified my portfolio to balance my investment.

I am largely invested in high-yield dividend-paying ETFs. I am holding Schwab U.S. Dividend Equity ETF (SCHD) and Vanguard High Dividend Yield ETF (VYM). My second largest sector is tech followed by the healthcare and financial sector.

My highest position is in Apple Inc (AAPL) although I did not invest the most in this stock. The last time I purchased Apple was in 2018. Since then the stock price has increased more than 3 times. I am only doing the DRIP every quarter for all the stocks.

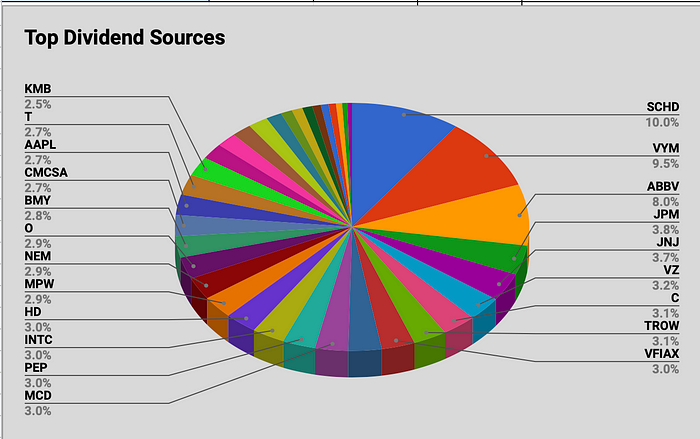

Tracking the dividend source percentages is also very important. I plan not to exceed more than 5% dividend income from any individual stocks. Only Abbvie (ABBV) is more than 5% in dividends. I bought a large amount of this stock in 2019 when the stock price dropped below $70. I have no plan to add this stock anytime soon. If any stock cut its dividends, that will negatively impact dividend income. This year At&t (T) cut their dividends in half which lowered my dividend income. Also, two financial companies JP Morgan (JPM), Citi Bank ©, and Newmont Corp. (NEM) did not raise their dividend this year. Other than these stocks, all the rest of the stocks raised their dividends this year.

Dividend Income in November:

In November 2022 I earned a total of $178.55. That’s a laughable amount to a lot of you but I just want to share how regularly investing in dividend stocks will generate passive income and the growth of income every year. 5 years ago I was earning nothing but now I am earning $215 per month for just investing in stocks. In the last year in the same month, I earned $155.51 so my income has increased by 14.82% from the last year. This year I opened a new position in JP Morgan Chase (JPM) and copper mining company Freeport-McMoran (FCX). I added more positions in Verizon (VZ), Citi Bank ©, Starbux (SBUX), and Realty Income (O). I also have an interest income of $14.8 from my high-yield savings account in Synchrony bank which is currently paying 3.5% interest. Other sources of increase are due to the DRIP investing and dividend increase.

Annual Dividend Income:

At the beginning of 2023, my annual dividend income is $2,583.38. In the last year, my income was $1,588.92 which is a 62.59% increase from the previous year. In 2020 and 2021, my income was almost the same as I sold a good amount of my stocks to pay the downpayment on my first home at the end of 2020.

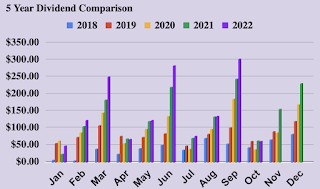

The column chart below shows the growth of my dividend income monthly basis for the last five years. You can see from the chart how my income is increasing every year. I am achieving this just by investing in dividend stocks on a monthly basis and reinvesting the dividends.

The quarterly chart also shows the increase in my income quarterly. If I keep investing as planned it will grow rapidly as the compounding interest will play a bigger role with time.

The table below shows the Yield on Cost (YOC) and the current yield of my current portfolio holdings. My biggest gainers are Apple (AAPL), Microsoft (MSFT), Mastercard (MA), Visa (V), etc. I have most of these big gainers between 2017 and 2018. Another noticeable thing you will see that the YOC for Apple, Microsoft, Mastercard, and Visa. The current yield is too low for all of them, but my YOC is quite high, especially for Microsoft at 3.09%. This happened because of their big dividend increase every year. It is increasing my yield every year. YOC is calculated by dividing a stock’s current dividend by the purchased price while the current yield is calculated by the current dividend by the current stock price.

The stocks in the red zone or the negative gain stocks are all my recent buys except for 3M (MMM). I am in negative gains for quite a long time for 3M. Currently, I am reinvesting the dividends to dollar cost averaging. I bought Caterpillar (CAT) and Chevron (CVX) during the pandemic low and they more than doubled since then.

Dividend Raise:

This year most of the companies in my portfolio increased dividends. Only At&t (T) cut its dividends to half. This stock hurts my dividend income this year. Other than that Citi Group ©, Freeport McMoran (FCX), JP Morgan (JPM), and Newmont Corp (NEM) did not raise their dividends. My top 3 stocks in terms of dividend increase are Visa (V) 20%, Black Rock (BLK) 18%, and Home Depot (HD) 15%.

November Purchase:

In November, I opened a position in Medtronics (MDT). This is a $102B Irish company that develops and manufactures medical therapy devices for healthcare systems worldwide. The company has a long history of success and a solid business model. Recently the price of the stock dropped significantly. I was watching the stock for a good entry price. I have added at $77.2 average price. Holding this stock for the long term will give a good return. Also, the price of the stock was 42% lower than its all-time high ($135.16). The yield is 3.53%, the payout ratio 51.13%, PE ratio is 14.5, and the 5-year CAGR is 8.62% which makes the stock a buy for me.

The current low price and the high dividend yield make this stock very interesting. I will keep adding until it reaches 2.5% of my portfolio.

The stock’s free cash flow is 3.598 per share. Free cash flow indicates a company’s ability to pay dividends, increase dividends in the future, pay down dividends, and also to grow the business. Although the cash flow decreased recently, it is still higher compared to the beginning of 2021. The price to free cash flow also increased higher recently to 21.43 which is a little bit higher. Generally, 15 to 20 is good. Also, the company’s debt-to-equity ratio dropped, and currently, the value is 0.458 which is not great but anything below 0.5 is considered good.

I have used Macrotrends for the charts. They are free to use.

Conclusion:

I have shared my dividend growth portfolio to make an interesting topic about dividend investing for new investors to grow wealth and earn passive income by just investing in those stocks. I have also highlighted the importance of dividend reinvesting and compounding interest. I have also shared my November purchase. I purchased Medtronic Inc. (MDT) in my dividend portfolio and I am holding it for long-term.

Disclaimer: I am not a financial advisor and I am not advising anyone to buy or sell any stocks. This author will not be liable for any type of financial damage that may occur by following my articles. I am just sharing my portfolio with everyone if anyone likes my strategy and gives me feedback. Please do your own analysis before investing in any companies.

This blog was originally written on Medium by the author.