I am a long term dividend growth investor who loves to invest in dividend growth stocks. I invest for long term and focusing to invest each month with 10% of my salary and want to reach financial freedom before I retire. I am updating my portfolio every month and sharing it with all of you.

Thursday, March 17, 2022

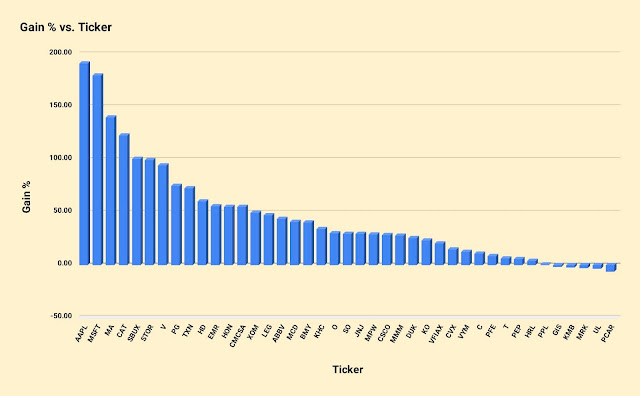

Overall performance of my total portfolio since August 2017

Saturday, September 4, 2021

Dividend Income August 2021

Dividend Update August 2021

Hello guys, today I am sharing the total amount of dividends that I have received in August 2021. Currently, I am maintaining three different portfolio. My major investment is in dividend paying stocks. I am also in some non-dividend stocks which are growth companies with the tremendous potential to grow. In my blog you can see all the details of those portfolios. In August, I have opened three new positions in Verizon (VZ), Newmont (NEM), and Intel Corp. (INTC). I have also added Clorox (CLX) and Campbell Soup (CPB) into my position. The table below shows the dividends that I have received in August 2021.

Sunday, May 2, 2021

Dividend Income in April 2021

Dividend Update April 2021

Hey guys, today I am sharing with you the amount of dividends I received in April 2021. Currently, I am maintaining three different portfolios. My main portfolio is only dividend stock portfolio. I also invest in Aggressive stocks and ETFs and a Roth IRA. In my blog you can see all the details of those portfolios. IN April, I have added Viatris (VTRS) which recently spin offed from Pfizer (PFE). They are going to initiate dividends from May 2021. They are down almost 30% from all time highs so I added them in my portfolio. The table below shows the dividends that I received in April 2021

Monday, March 29, 2021

How much money I am getting from my Dividend Stocks portfolio

Portfolio Update - February 2021

Hey guys, today I am going to share with you how much money I am getting from my dividend investment portfolio. I maintain three different portfolios. The 80% of my investment goes to this portfolio. Other 10% goes to aggressive investment like TQQQ, QLD, UPRO, and ARK funds. The rest 10% goes to crypto. I have sold 50% of my crypto holdings and took some mind-blowing profit. Now comes the headache of estimated tax filing for quarter 1. Ok lets dig into my dividend stock portfolio. In this portfolio I invest into stocks which has record of paying dividends and increase the dividend rate every year. Investing in dividend paying stocks are sometimes boring but it helps to grow your wealth gradually. By investing in more dividend stock your income will increase in two different ways. Investing in dividend stocks will increase your income and the second source of increase is the dividend rate increase. The dividend stocks in my portfolio increase their dividends on average 4% per year. So if you think about longer term with a larger investment this increase every year will boost your income significantly. By following this rule, Warren Buffett is earning $3.8 billion per year in dividends according to NASDAQ website. Now lets jump into the stocks in my portfolio:

The chart below shows the gain vs. tickers. The stocks that I am losing are mostly new investments. The least growth stocks that I am holding for long time is At&t (T) and Ppl (PPL).

Friday, March 12, 2021

Monthly Dividend Update - February 2021

Monthly Dividend Update - February 2021

Hey Guys, today I am going to share my dividend status of my portfolio. I am maintaining three different portfolios. The other portfolios are based on aggressive growth portfolio which has much higher risk but will have chance to get much higher return and the last portfolio is for the cryptos. 80% of these investment goes to my dividend portfolio and the 10% for the aggressive growth and crypto portfolio. In February, I have added PepsiCo ($PEP) $PPL, Merck ($MRK), and Unilever (UL) in my dividend portfolio. In my retirement account I have added Vanguard High Yield ($VYM). The table below shows the dividends that I have received in February 2021. This month my major incomes are from ABBV and T. I have also earned from AAPL and BMY.

The following chart shows the dividends received monthly from my portfolio. The chart indicates the growth of my monthly dividends with time. If I keep investing and hold in these great companies, my income will continue to grow with time.

The following chart compares my monthly dividends on a yearly basis. In the last month, I have received $104.62. Last year, I received around $80 in the same month.

The next chart shows the total amount of dividends that I have received quarterly. My income is gradually increasing in every year.

On yield basis, the current yield of my overall portfolio is 2.72% however, my yield on cost (YOC) is 3.77%. The YOC will continue to increase because the dividend paying stocks always increase their dividends yearly so the YOC will only increase with time. On the other hand, the current yield depends on the market. If the market is in bull mode then yield will drop but will increase if the market is in bear mode. The later condition means its a buying market. That's why I always hold cash to utilize the opportunity.

The following figure shows the YOC and current yield comparison with time. My YOC is gradually increasing with time while the current yield fluctuated in the same range which depends on the market condition. On the other hand the YOC increases with time because most of the companies increase their dividends yearly and it does not fluctuate with the market condition.

The chart below shows the average dividend income received monthly and the average amount of dividends received monthly. This chart helps me to understand my monthly dividends and total yearly projected dividends. I am slowly investing in dividend paying stocks and if I continue to do like this income will continue to grow.

The chart and the table below summarizes my dividend distribution in the portfolio. The most percentages of dividends I am receiving are from the Vanguard High Yield (VYM), AbbVie (ABBV), At&t (T), and Kimberly Clark (KMB). They are 35% of my total dividends that I receive yearly.

Dividend sources in the table format:

The following tree-map shows the percentages of dividends that I am receiving from the individual stocks and also compares between the sectors. it help me to understand which sectors are paying me the most in dividends. The map shows that I am getting the highest amount of dividends from the health sectors followed by consumer defensive, ETFs, and consumer cyclical.

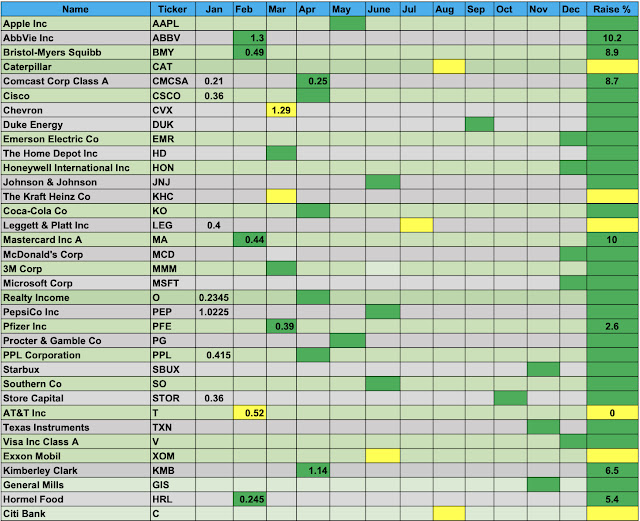

The following table shows the dividends that I received from my positions in each month. This chart is very helpful to track my monthly income through dividends.

The next table shows the total amount of dividends received so far in 2021. In February, I have received $104 which is the highest so far in this part of the quarter.

The next table shows my dividend growth performance in the year 2021. last year, none of my holdings cut their dividends.

Sunday, February 14, 2021

Stocks that will give you peace in your retirement

Portfolio Update - January 2021

Today I am going to share the status of my portfolio at the end of January 2021. My plan is to gradually invest in the stocks that pay dividends and increase the dividends in every year. Investing in dividend stocks is kind of boring but it will help your wealth grow effectively with time with less risk compared to non-dividend paying stocks. They perform good when the market foes to bear mode. Because I am young so I have decide to invest 20% of my invest into aggressive stocks and in the cryptos. I invest a small portion in non-dividend paying stocks like Amazon (AMZN), Google (GOOG), Tesla (TSLA) etc. I also invest a small percentage in the cryptos. I mostly invest in Bitcoin and Ehteruem. Other notable cryptos that I am invested in is Binance Coin (BNB), Chainlink (LINK), Crypto.com (CRO), and VeChain (VET). Recently I have sold some of the cryptos to take profit. Currently I am only buying USDC. These risky positions will help me to build my wealth faster than the dividend paying stocks considering my age. When I will be close to my retirement I can sell these positions and will be able to buy a lot of dividend paying stocks for the retirement income. The table below shows my current portfolio distribution:

Saturday, February 6, 2021

Monthly Dividend Update - January 2021

Monthly Dividend Update - January 2021

Hey guys, today I am sharing with you my dividend status of my portfolio at the end of January 2021. In January, I was very active in buying stocks. I have initiated my positions in General Mills (GIS), Hormel Foods (HRL), and Citi Bank (C). I have also purchased Kimberley Clark (KMB) and PPL Corp (PPL) stocks in my portfolio. I have also purchased Vanguard High Yield (VYM) in my retirement portfolio. As I have written in my previous blogs that I invest 80% in dividend paying stocks, 10% in non-dividend paying stocks, and the rest 10% in the Cryptos. At this current condition, I am not adding any cryptos. I am investing that money into non-dividend paying stocks. The table below shows the dividends that I received in January 2021. This month my income was too little as I sold a good number of stocks to get cash to buy my first home.

The following chart shows the dividends received monthly from my portfolio. The chart indicates the growth of my monthly dividends with time. If I keep investing and hold in these great companies my income will continue to grow with time.

The following chart compares my monthly dividends on a yearly basis. In the last month, I have received only $23 while last year in the same month I received around $60. It dropped significantly because I sold some of my major holdings such as JP Morgan (JPM), Medical Properties (MPW), and PPL Corporation (PPL).

The next chart shows the total amount of dividends received in each quarter and compares the total amount of dividends with the previous years.

On yield basis, the current yield of my overall portfolio is 2.68% however, my yield on cost (YOC) is 3.82%. The YOC will continue to increase because the dividend paying stocks always increase their dividends yearly so the YOC will only increase with time. On the other hand, the current yield depends on the market. If the market is in bull mode then yield will drop and will increase if the market is in bear mode. The later condition will give you buying opportunity.

The following figure shows the YOC and current yield comparison with time. My YOC is gradually increasing with time while the current yield fluctuated in the same range which depends on the market condition. On the other hand the YOC increases with time because most of the companies increase their dividends yearly and it does not fluctuate with the market condition.

The chart below shows the average dividend income received monthly and the average amount of dividends received monthly. I am slowly increasing my passive income and if I continue to invest in the dividend paying stocks it will only grow with time.

The chart and the table below summarizes my dividend distribution in the portfolio. The most percentages of dividends I am receiving are from the Vanguard High Yield (VYM), Abbvie (ABBV), At&t (T), Johnson & Johnson (JNJ), and Home Depot (HD) etc. They are the 40% of my total dividend incomes.

Dividend Source in the table format:

The following tree map shows the percentage of dividends that I am receiving from the individual stocks and also compares between the sectors. It helps me to understand which sectors are paying me the most in dividends. The map shows that I am getting the highest amount of dividends from the health sectors followed by the consumer defensive, ETFs and consumer cyclical.

The following table shows the dividends that I received from my positions in each month. This chart is very helpful to track my monthly income through dividends.

The next table shows the total amount of dividends received so far in 2021. In January, I have received a small amount of dividends but in the next cycle I will receive more dividends because I invested in KMB and PPL.

The next table shows my dividend growth performance in the year 2021. Last year, none of my holdings cut their dividends. Only 4 of them did not raise their dividends other than that all of them raised dividends.