Monthly Dividend Update - August 2020

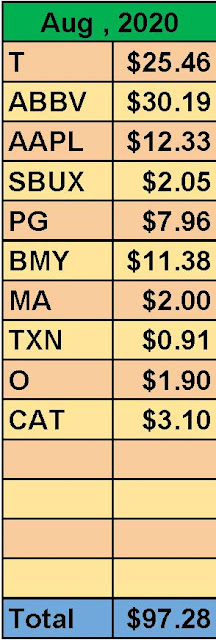

Hello everyone, today I am sharing my updated dividend growth portfolio at the end of August 2020. I always keep track of my investment portfolio in google sheet. It helps me to understand my portfolio performance so that I can make the right decision of my trades and in which direction my portfolio is going. For the last two months I did not invest anything. There two reasons for that. First reason is that I am looking to purchase my first home. The interest rates are really low and I am looking for a conventional loan with a fixed rate for 30 years. And the second is that the market is for quite a long time.. I think it should drop significantly. I am investing only 10% of my salary for investing. My main investing strategy is to invest in dividend-paying stocks however, I also invest a very small percentages on non-dividend paying stocks and in the Cryptos. So every month out of that 10%, I invest 80% in dividend-paying stocks, 10% in non-dividend paying stocks, and 10% in crypto currencies. All of my investments are for the longer term. I don't sell stocks that often. In August, I did not purchase any stocks but I have purchased Vanguard High Yield (VYM) ETF in my retirement accounts. My employer buys Florida Retirement System mutual funds which I don't like. So I have transferred 40% of my fund to a self-brokerage account and purchased VYM. I have raised $103 in dividends by adding VYM to my retirement funds. I have also added my wife's retirement account and she is buying Vanguard Admiral (VFIAX) through her employer. In the last month I have received $97.28 in dividends. Most of the dividends came from Abbvie (ABBV) and At&t (T). I have also received dividends from Bristol Myers (BMY), Apple (AAPL), Starbux (SBUX), Procter & Gamble (PG), Caterpillar (CAT), and MasterCard (MA). I have reinvested all the dividends that I received.

The following chart shows the dividends received monthly from my portfolio. The chart indicates the growth of my monthly dividends with time. If I keep investing in these stocks, my income will only grow with time.

The following chart compares my monthly dividends on a yearly basis. In the last month, I have received $97.28 while in the same month in 2019 I have earned $81.

The next chart shows the total amount of dividends received on a quarterly basis. My previous two years have seen an increase in dividends every quarter. This year my income drops a little bit because I have sold my entire positions in BAC, JPM, and IRM. All the companies reported lower earnings but unfortunately the market is continuing its positive trend. The PE is going up so as the payout ratios.

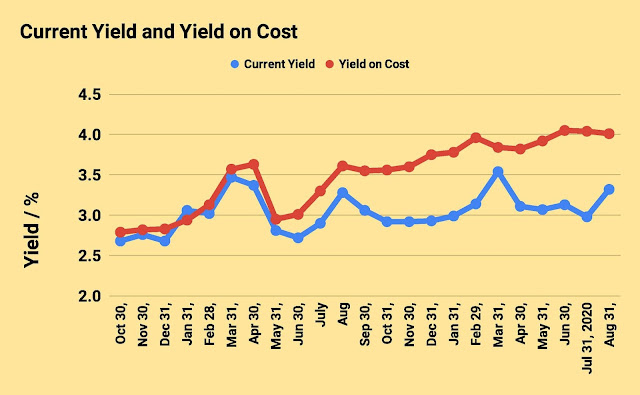

On a yield basis, the current yield of my overall portfolio is 3.32% while the YOC is 4.01%. The YOC is higher than the current yield because the companies in my portfolio increase their dividend payouts on a yearly basis. So for the longer run, the YOC will only keep going up unless any company cut their dividends.

From the following curve, we can see a comparison of the current yield vs. the YOC and it is clear that the YOC is slowly increasing with time.

The chart below shows the average dividend income received monthly and the average amount of dividends received monthly. I am slowly increasing my passive income and if I continue to invest in the dividend-paying stocks it will only grow with time.

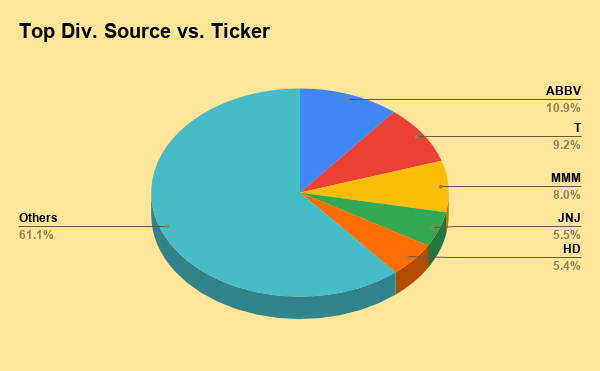

The chart and table below summarize my dividend distribution in the portfolio. The most percentages of dividends I am receiving are from Abbvie (ABBV), At&t(T), Vanguard High Yield (VYM), and 3M (MMM). They are the source of more than 30% of my total dividends.

The following treemap shows the dividends I am receiving from individual stocks and also compares between the sectors. I am getting the highest amount of dividends from the health sector followed by the industrial, and consumer cyclical.

The following table shows the dividends that I received from my positions in each month. This chart is very helpful to track my monthly income through dividends.

The next table shows the total amount of dividends received in 2020 from my stocks positions. In August I have received $97.28 and in 2020 I have received $711 in dividends.

The next table shows my dividend growth performance in the year. Out of 36 stocks 17 of them increased their dividends while BP is the only stock who cut their dividends to half.